Asia-Pacific Insights

Exploring the latest trends and news in the Asia-Pacific region.

Insurance Showdown: Battle of the Policies

Discover the ultimate showdown of insurance policies! Uncover the pros and cons to find the best coverage for your needs. Don't miss out!

Understanding the Key Differences Between Health and Auto Insurance: Which Policy Wins?

When navigating the world of insurance, understanding the key differences between health insurance and auto insurance is crucial for making informed decisions. Health insurance primarily covers medical expenses and services, ranging from routine check-ups to emergency surgeries. It protects you and your family from the high costs of healthcare, ensuring you have access to necessary treatments without incurring overwhelming debt. On the other hand, auto insurance is designed to safeguard you and your vehicle against damages resulting from accidents, theft, or natural disasters. Each type of policy serves distinct purposes and operates under its specific regulations and requirements, making it essential to choose the right coverage for your needs.

When comparing which policy wins between health insurance and auto insurance, it ultimately depends on individual circumstances and priorities. If your primary concern is safeguarding your health and well-being, then investing in robust health coverage should be your focus. Conversely, if you rely heavily on your vehicle for daily commutes or business, having comprehensive auto insurance is imperative. Consider factors such as your financial situation, lifestyle, and healthcare needs, as well as the legal requirements for auto insurance in your area, as these will influence your decision in choosing the right policy for your unique needs.

Top 5 Insurance Myths Debunked: What You Need to Know

When it comes to insurance, there are many myths that can lead to confusion and costly mistakes. One common myth is that all insurance policies are the same. In reality, policies can vary significantly in terms of coverage and exclusions. For example, a basic health insurance plan may only cover essential medical services, while a comprehensive plan might include additional benefits like mental health support and alternative therapies. Understanding the different types of insurance and what they cover is crucial for making informed decisions.

Another pervasive myth is that young, healthy individuals don't need insurance. While it may seem tempting to forgo coverage when you're in good health, unforeseen circumstances can change everything. Accidents and sudden illnesses can happen at any time, resulting in substantial financial burdens without proper coverage. It's essential for everyone, regardless of age or health status, to consider insurance as a necessary safety net. By debunking these common myths, you can make better choices about your insurance options and ensure your financial security.

How to Choose the Right Insurance Policy for Your Needs: A Comprehensive Guide

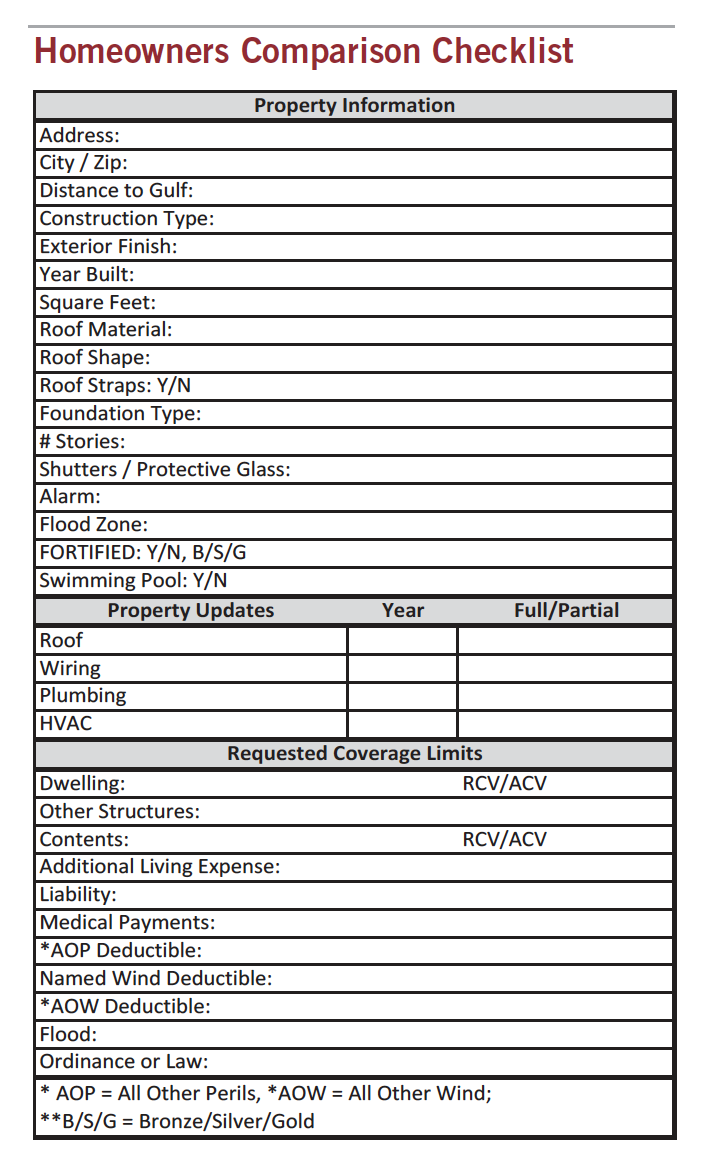

Choosing the right insurance policy can be a daunting task, especially given the vast array of options available in the market. The first step is to assess your personal needs and financial situation. Start by making a list of the types of coverage you require—whether it's for health, auto, home, or life insurance. Consider factors such as the value of your assets, your income, and any dependents you may have. Understanding your unique circumstances will guide you toward the policies that best fit your needs.

Once you've identified your requirements, it's essential to compare policies effectively. Create a side-by-side comparison of key features, premiums, deductibles, and coverage limits. Additionally, pay attention to the insurer's reputation and customer service ratings, as these will impact your overall satisfaction. Make sure to read the fine print to uncover any exclusions or limitations that might affect your coverage. Finally, consult with a licensed insurance agent or financial advisor who can offer tailored advice and help you navigate the complexities of selecting the perfect policy.