Asia-Pacific Insights

Exploring the latest trends and news in the Asia-Pacific region.

Life Insurance: Your Safety Net or Just a Safety Blanket?

Discover if life insurance is your ultimate safety net or just a comforting blanket. Uncover the truth behind your coverage today!

Understanding Life Insurance: A Comprehensive Guide to Your Financial Safety Net

Understanding Life Insurance is crucial for anyone looking to secure their financial future and provide stability for their loved ones. Life insurance acts as a protective financial measure, ensuring that in the event of untimely death, your family is not burdened with debt or loss of income. Here are some key types of life insurance:

- Term Life Insurance: Offers coverage for a specific period.

- Whole Life Insurance: Provides lifelong protection with a cash value component.

- Universal Life Insurance: Combines flexible premiums with a savings component.

When considering life insurance, it's essential to evaluate your personal circumstances, including dependents, financial obligations, and long-term goals. A common question that arises is, "How much life insurance do I need?" A general rule of thumb is to have coverage that is 10 to 15 times your annual income. Additionally, taking the time to compare policies and consult with a financial advisor can help you make an informed decision. Ultimately, understanding life insurance is not just about financial protection; it's about peace of mind for both you and your family.

Is Life Insurance Worth It? Debunking Myths and Exploring Benefits

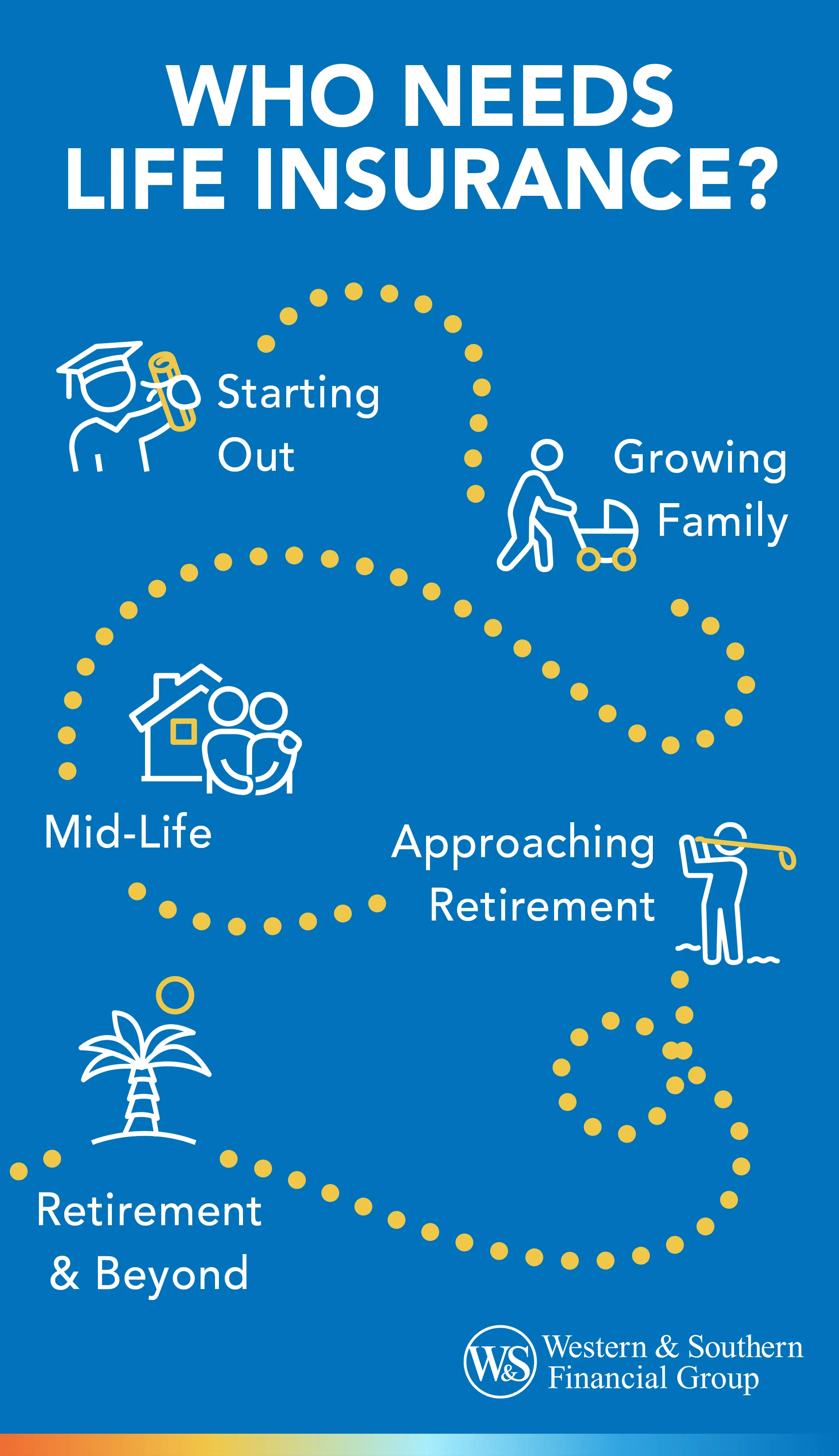

When considering whether life insurance is worth the investment, it's essential to debunk some common myths. Many people believe that life insurance is only for the wealthy or elderly, but this is far from the truth. In fact, securing a policy at a younger age can be much more affordable and advantageous. Additionally, some individuals worry that they'll be wasting money on premiums if they don't pass away during the term; however, life insurance serves as a critical financial safety net for loved ones, providing peace of mind that their future is protected irrespective of when the policyholder might pass.

The benefits of having life insurance extend beyond mere death benefits. For instance, a policy can help cover outstanding debts, such as a mortgage or student loans, ensuring that these burdens don’t fall upon your family during an already difficult time. Moreover, depending on the type of policy, some options even offer cash value accumulation, which can be borrowed against in times of need. By investing in life insurance, you're not only safeguarding your family’s financial future but also providing them with the means to navigate life’s unexpected challenges.

What Types of Life Insurance Are Right for You? Exploring Your Options

When it comes to choosing the right life insurance, it's important to understand the different types available and how they can align with your financial goals. Term life insurance is often the most affordable option, providing coverage for a specific period, usually between 10 to 30 years. If your primary goal is to ensure financial security for your dependents during your working years, this type may suit you best. On the other hand, whole life insurance offers lifelong coverage and builds cash value over time, making it an appealing choice for those looking for both protection and a savings component.

Additionally, there are options like universal life insurance, which combines flexible premiums with the potential for cash value growth, and variable life insurance, which allows you to invest the cash value in various options like stocks and bonds. Each of these policies comes with its own set of advantages and considerations. To make an informed decision, assess your current financial situation, future goals, and the needs of your beneficiaries. Consulting with a financial advisor can further enhance your understanding of these options to ensure you select the most suitable life insurance policy.