Asia-Pacific Insights

Exploring the latest trends and news in the Asia-Pacific region.

Why Pay More? The Secret Life of Insurance Comparisons

Unlock the secrets of insurance comparisons and discover why paying less could save you more! Dive in now!

Unlocking the Mystery: How Insurance Comparisons Save You Money

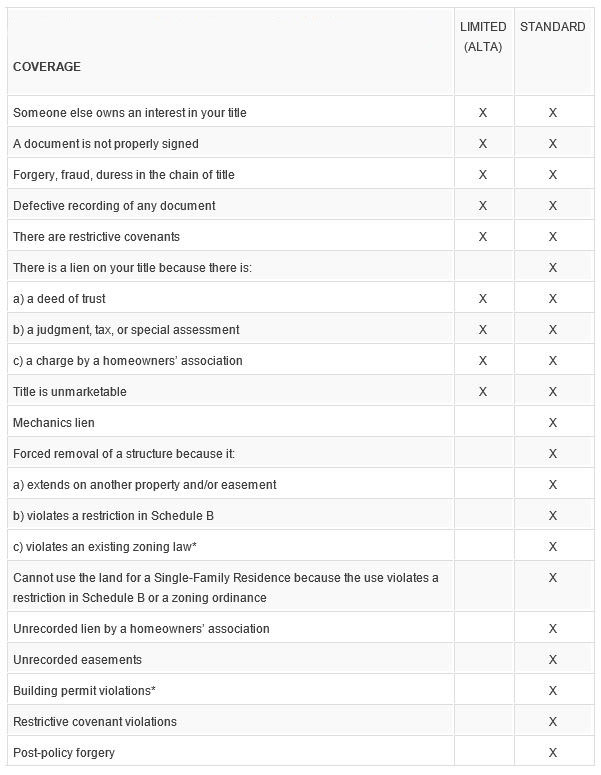

When it comes to finding the best insurance policy for your needs, insurance comparisons are an invaluable tool. By analyzing various options side by side, consumers can easily identify differences in coverage, premiums, and deductibles. This process not only saves time but also ensures that you're making informed decisions. For instance, a comprehensive review might reveal that one provider offers a lower premium for the same coverage as another, resulting in significant savings over time. Furthermore, comparing multiple quotes can expose discounts that you may not be aware of, potentially further reducing your overall costs.

Beyond just financial savings, insurance comparisons also empower you with knowledge about your options. Instead of settling for the first policy you find, you can explore a range of alternatives, giving you the confidence to negotiate better terms. With so many providers and plans available, it's easy to feel overwhelmed; however, by utilizing comparison tools, you can break down the complexities of insurance into manageable pieces. In the end, taking the time to compare your options allows you to choose a policy that not only fits your budget but also aligns with your personal needs, ultimately unlocking the mystery of how insurance can work for you.

The Hidden Benefits of Comparing Insurance Policies: What You Need to Know

When it comes to purchasing insurance, many consumers are unaware of the hidden benefits of comparing insurance policies. Not only does this practice help you secure a better price, but it also provides insights into the varying levels of coverage offered by different providers. By taking the time to analyze multiple options, you can identify the unique features of each policy, which may include additional benefits such as roadside assistance, rental car reimbursement, or enhanced liability coverage. This comprehensive understanding empowers you to make a more informed decision that aligns with your specific needs.

Moreover, comparing insurance policies can lead to significant savings in the long run. Many consumers overlook the fact that insurance rates can fluctuate based on market conditions, personal circumstances, and even seasonal trends. By consistently reevaluating your options, you create an opportunity to discover lower premiums or more favorable terms that may not be evident at first glance. Additionally, it encourages carriers to offer competitive rates, ensuring that you are not only protected but also economically savvy. Remember, investing a little time in comparison can yield substantial financial benefits for your future.

Are You Overpaying? The Truth Behind Insurance Rates Explained

Are you overpaying for your insurance? It's a question that has crossed the minds of many consumers, especially as they review their policies each year. The truth is, insurance rates can vary significantly based on a multitude of factors such as your location, driving history, and even your credit score. For instance, insurance companies often assess risks differently, which can lead to discrepancies in rates. Understanding how these factors interact can help you make more informed decisions and potentially save you money.

To determine if you are truly overpaying, start by shopping around and comparing quotes from multiple insurers. Create a list of your current coverage details and analyze the types of discounts that are available to you, such as bundling policies or maintaining a safe driving record. Additionally, reviewing your coverage limits and deductibles can provide insight into whether you are adequately protected without overextending your budget. By taking these steps, you can uncover the truth behind your insurance rates and ensure you're getting the best value for your hard-earned money.